It wasn’t long ago that the clamoring for CEO’s to get with the latest program by using Twitter and various social media platforms, reached a feverish pitch. As usual, those forever looking for shreds of evidence that ‘social media’ pays out a clear cut ROI, would trot out lists of companies (and their CEO’s) who ‘got it’. Funny thing was, most of those lists, and many related cased studies were mainly of obscure companies in the early stages of growth. Naturally, a 500% growth rate as a result of using Twitter, was impressive though less so when the base number for that growth rate was near zero, the kind of stats that investment fund advisors like to use when people have little appetite for buying stocks following a market meltdown.

It wasn’t long ago that the clamoring for CEO’s to get with the latest program by using Twitter and various social media platforms, reached a feverish pitch. As usual, those forever looking for shreds of evidence that ‘social media’ pays out a clear cut ROI, would trot out lists of companies (and their CEO’s) who ‘got it’. Funny thing was, most of those lists, and many related cased studies were mainly of obscure companies in the early stages of growth. Naturally, a 500% growth rate as a result of using Twitter, was impressive though less so when the base number for that growth rate was near zero, the kind of stats that investment fund advisors like to use when people have little appetite for buying stocks following a market meltdown.

There have been case studies, some from reputable technology analysts, touting remarkable cost savings. Beyond the headline, the data showed a savings of $4M over 3 years for a certain USD$100B technology provider using social media as a collaboration tool. In the end, this seemed a bit on the light side. No pun intended here but greater savings might have been had by turning the office lights off when people left for the day.

There has also been a lull in those declaring their location. Shout outs for Foursquare and various locational platforms seem rather muted of late. The initial interest seemed to be focused around luring people into retail premises by pushing discounted offers out to the latte-rati, more recently up-sized to the Starbucks version of 7-Eleven’s Big Gulp. Adoption hasn’t been that broad and one wonders if location-based applications are still looking for a real business problem to solve.

Lastly, not to make too fine a point, recent press by ‘those in the social know’ are now suggesting that too many offers, tweets, friending by brands for the sake of friending and a general overloading of Facebook fan pages by some brands, has started to turn some people off. Mashable had some recent thoughts on this issue of why people are unfollowing certain brands. I also expressed in a post from last year, building on a thought piece by the Economist, that there is so much data out there, one wonders what is to be done with it all – and that was when YouTube, Facebook and the like where just getting ramped up with the posting of video and photos. Clearly, when a brand fails to deliver on the promise, even CEO tweets can’t come to the rescue, GAP logo changes notwithstanding. Again, ask yourself, are we solving a business problem or just creating stuff to do because we’re not sure exactly what to do?

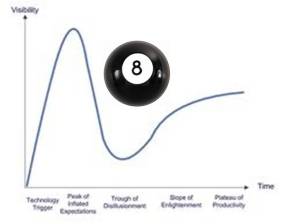

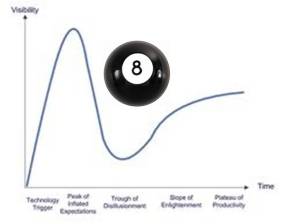

If you’re indeed feeling both ahead of the curve implementing certain technologies and behind the eight ball in terms of getting measureable business results, consider this: any organization that undertakes a transformation, in this case toward the Social Enterprise, cannot achieve success by leading with technology. This is what happened to early adopters of CRM in the last decade. Success can in fact be achieved, notably for companies that are truly customer-centric (culture/process/technology) who understanstand those things that deliver value to the customer relative to competition re. the “Outside-In” approach. IBM, Ford, McDonald’s, P&G are a few companies who do this consistently and have the financial results as proof.

This is not news, in fact, it’s an old principle advocated by Peter Drucker some 50 years ago. While it’s tempting to drink the latest elixir of technology, it pays to stick to managerial fundamentals, much like accountants use GAAP methods to keep track of every dollar earned.

– Ted Morris, 4ScreensMedia

![]() As part of a continuing series for the ACA – Association of Canadian Advertisers, the following post offers an ‘enterprise view’ of how to organize for social media. For the most part, advertisers are keely aware that any customer-facing activity does not fall exclusively within the domain of a singular function, department or business discipline. Indeed, the cross-enterprise approach is often the only way to provide a consistent delivery of customer value and in turn get feedback on performance. This also avoids one of the most dangerous of obstacles that inhibits business transformation…

As part of a continuing series for the ACA – Association of Canadian Advertisers, the following post offers an ‘enterprise view’ of how to organize for social media. For the most part, advertisers are keely aware that any customer-facing activity does not fall exclusively within the domain of a singular function, department or business discipline. Indeed, the cross-enterprise approach is often the only way to provide a consistent delivery of customer value and in turn get feedback on performance. This also avoids one of the most dangerous of obstacles that inhibits business transformation…

It wasn’t long ago that the clamoring for CEO’s to get with the latest program by using Twitter and various social media platforms, reached a feverish pitch. As usual, those forever looking for shreds of evidence that ‘social media’ pays out a clear cut ROI, would trot out lists of companies (and their CEO’s) who ‘got it’. Funny thing was, most of those lists, and many related cased studies were mainly of obscure companies in the early stages of growth. Naturally, a 500% growth rate as a result of using Twitter, was impressive though less so when the base number for that growth rate was near zero, the kind of stats that investment fund advisors like to use when people have little appetite for buying stocks following a market meltdown.

It wasn’t long ago that the clamoring for CEO’s to get with the latest program by using Twitter and various social media platforms, reached a feverish pitch. As usual, those forever looking for shreds of evidence that ‘social media’ pays out a clear cut ROI, would trot out lists of companies (and their CEO’s) who ‘got it’. Funny thing was, most of those lists, and many related cased studies were mainly of obscure companies in the early stages of growth. Naturally, a 500% growth rate as a result of using Twitter, was impressive though less so when the base number for that growth rate was near zero, the kind of stats that investment fund advisors like to use when people have little appetite for buying stocks following a market meltdown.